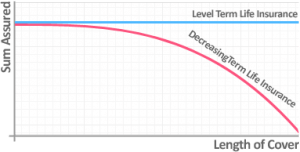

A mortgage life insurance policy will typically cost less than a level term life insurance policy which is designed to pay out the same fixed lump sum throughout the policy. Decreasing term life insurance also called mortgage life cover tends to cost less than level term for example because the pay out from the policy decreases with time.

Mrta Mlta Which Is Your Preference Propsocial

In addition any increases to the mortgage payment are generally limited to the rate of inflation per year meaning an overall increase to the amount you.

. Based on single-policy non-smoker. Thats according to managing partner Craig Tindall who has led the team for the past 13 years. Payment frequency options of weekly bi-weekly semi-monthly or monthly.

This means that the portion of your payment that goes toward the principal may rise or fall over the. Debt consolidation - but remember if youre consolidating debts like personal loans and credit cards it means youll be switching from unsecured debts to one that could put your home at risk of. Bankrate helps thousands of borrowers find mortgage and refinance lenders every day.

A 51 adjustable rate mortgage ARM or 5-year ARM is a mortgage loan where 5 is the number of years your initial interest rate will stay fixed. Fluctuating interest rates that could potentially be higher or lower over the term of your mortgage. Fixed vs variable interest rates.

The most common fixed periods are 3 5 7 and 10 years and 1 is the most common adjustment period. With a fixed rate mortgage the interest rate and the payment you make will stay constant for the term of your mortgage offering stability. Data based on level term life insurance policies purchased on GoCompare website between 25th August 2020 and 2nd December 2020.

Youll need to pay back what you borrowed by the end of the mortgage term. The duration of some variable rate tracker loans are elastic and can stretch the mortgage term by up to five years if rates increase so that your mortgage payment will remain the same even if rates increase by as much as 075. Its important to carefully read the.

Its a mortgage where you only pay the interest on the amount youve borrowed each month with interest charged on the full balance. See market value adjustment MVA For unitised with-profits policies we may apply a market value adjustment MVA if you decide to cash-in your policy or start taking pension benefits early transfer it to another company or switch it from the unitised with-profits fund. First Mortgage Direct Corporation Best no-fee lender.

Mortgage insurance or Mortgage Reducing Term Assurance MRTA protects your family from paying the outstanding mortgage on your home if you were to die or become permanently disabled. Check rates today to learn more about the latest 30-year refinance rates. Founded in 2007 under the name Principal Mortgage this 18-person company has been honored by Alabama Mortgage Professionals Association as the top mortgage broker in central Alabama for the past 3 years in a row.

An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity. With a variable interest rate mortgage the interest rate will change when the TD Mortgage Prime Rate changes. Youll need to earn at least 75000 a year if applying alone.

In Malaysia there are two types of mortgage life insurance available Mortgage Reducing Term Assurance MRTA or Mortgage Decreasing Term Assurance MDTA and Mortgage Level Term Assurance MLTA. Compare 30-year refinance rates and choose your preferred lender. A second charge mortgage might help you cover a number of things including.

Insurance is a means of protection from financial loss. The 1 represents how often your interest rate will adjust after the initial five-year period ends. Can I get an interest-only mortgage.

MRTA is a life insurance plan with decreasing sum. Lower Best for first-time homebuyers. The amount payable if you die during the term is normally sufficient to pay off the mortgage covered.

You choose a plan based on your current outstanding mortgage loan your policy term how long it will take to pay off your loan and the interest rate closest. The company offers a host of benefits for their. The option of converting into a fixed rate closed mortgage that we offer at the time of conversion with a term of 3 years or more at any time.

The application must be for a home that you. The best way to get an idea of how much you could expect to pay to protect your loved ones is by doing a quick comparison with Compare the Market filling in a few details about you and the. Customers who switch their mortgage online will receive 500 cashback to help cover their switch costs.

Which do you need as a homeowner. Mortgage insurance or Mortgage Reducing Term Assurance MRTA protects your family from paying the outstanding mortgage on your home if you were to die or become permanently disabled. However MRTA and MLTA are often misunderstood.

It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. The minimum mortgage amount is 100000 and the new mortgage must be set up as a closed fixed rate mortgage with a term between 2 and 5 years or a closed variable rate mortgage with a 5 year term. Why do people take out a second charge mortgage.

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mortgage Insurances How Mlta Differs From Mrta Malaysian Institute Of Estate Agents

Property Educational Articles Mpig

Mrta Vs Mlta Difference Comparison Table Easy To Understand

Mrta Vs Mlta Which Mortgage Insurance Is Better Iproperty Com My

Mortgage Insurance In Singapore Ultimate Guide For 2022

Mrta Vs Mlta Difference Comparison Table Easy To Understand

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mrta Mlta Which Is Your Preference Propsocial

Mlta Mortgage Level Term Assurance

Mrta Vs Mlta And How Much Coverage Is Needed Mypf My

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

Mrta Or Mlta What Are The Fallacies

Understanding Mortgage Insurance Hps Vs Mrta Vs Term Life

How Does Decreasing Term Life Insurance Work Guide Drewberry

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2022 Which One Is Better

5 Features That Differentiate An Mrta From An Mlta Property Talk Malaysia

What Is Mortgage Reducing Term Assurance Mrta

Decreasing Term Life Insurance Life Insurance Glossary Definition Sproutt

- what to do in kuala terengganu

- contoh surat permohonan penambahan pegawai

- logo jabatan kebajikan masyarakat

- klinik kesihatan logo

- straits quay convention centre

- how to issue preference shares in malaysia

- pacific rim 2 malaysia

- bagaimana mahu menjual kereta

- deco rumah tema biru

- kelebihan batu jet putih

- kata kata saidina umar

- cara membuat nama dengan menggunakan asap

- japanese restaurant ipoh

- jual kereta toyota wish

- ubat pelurus rambut terbaik

- ubat mkn utk rambut

- highest temperature in malaysia

- undefined

- mortgage reducing term assurance

- mee udang mak jah